Markets Confusing? Ask Edgen Search.

Instant answers, zero BS, and trading decisions your future self will thank you for.

Try Search Now

Alpha Trading: The Smart Way to Beat the Market

What Is Alpha Trading?

Most crypto traders lose money. Why? They lack a critical edge. An edge called “alpha”.

Alpha trading involves outperforming market benchmarks consistently. It goes beyond basic charts or fundamentals. Today's market moves according to narratives, data trends, and social momentum.

AI-driven platforms like Edgen AI process vast market data instantly, identifying hidden patterns and alpha signals human traders miss. By combining blockchain analytics, social sentiment, and advanced AI, Edgen removes blind spots and provides a competitive advantage.

Defining Alpha in Trading

Alpha measures returns beyond standard market performance. put:

For example:

- If the market benchmark grows by 7%, but your portfolio rises 12%, your alpha equals +5%.

- That extra 5% results from better market intelligence, faster reactions, and smarter decisions.

That extra 5% results from better market intelligence, faster reactions, and smarter decisions. For a more detailed overview of how alpha works in portfolio performance, check out the Corporate Finance Institute’s explanation of alpha.

How Traders Find Alpha Today

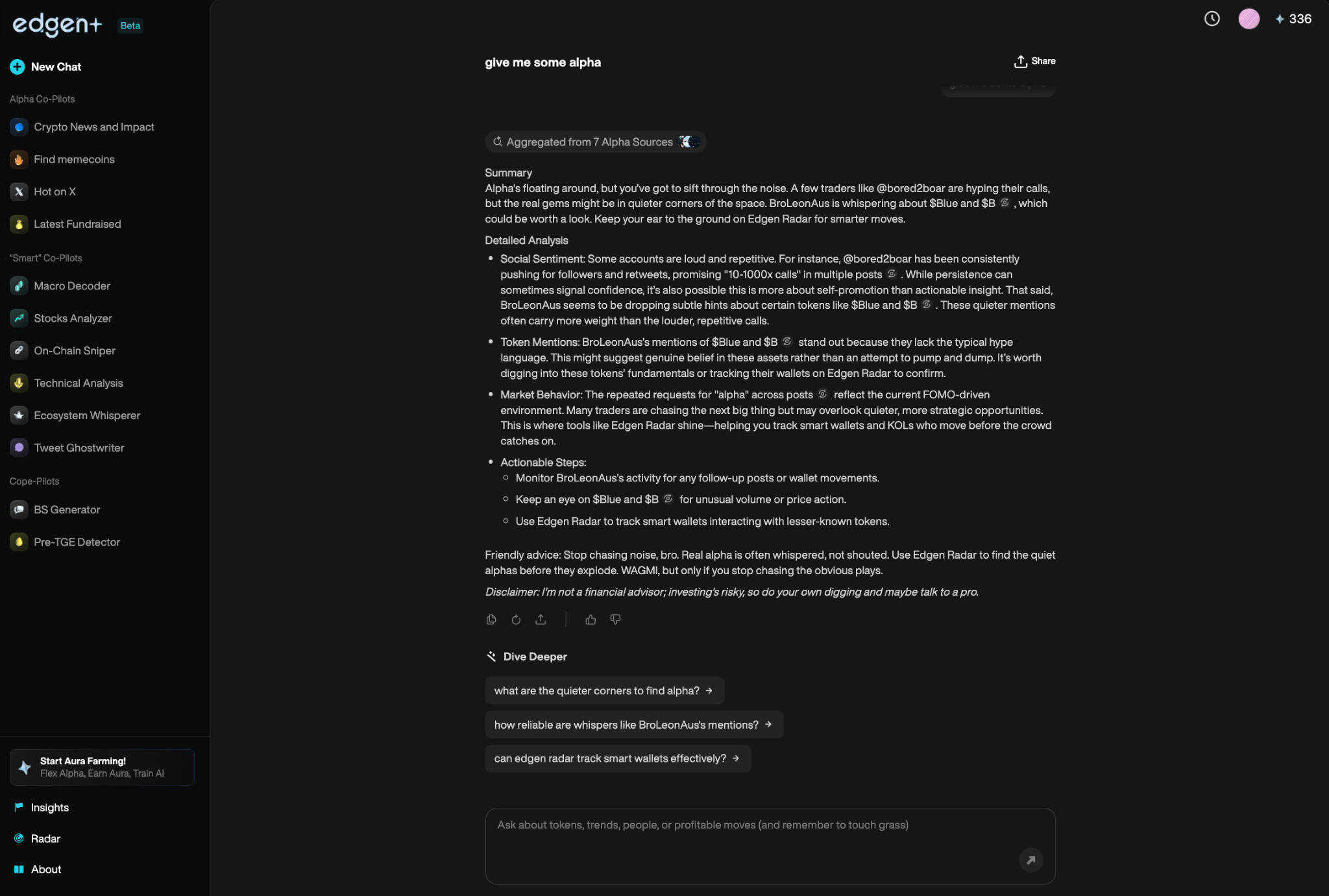

Alpha signals appear from identifiable sources:

- AI-Driven Insights: Machines analyze vast datasets beyond human capability.

- Social Sentiment Tracking: Market movements often follow social media-driven narratives.

- On-Chain Analytics: Significant wallet activities indicate potential shifts .

- Rapid Market Response: Quick reactions determine profitability in volatile markets.

Traditional trading methods provide incomplete visibility. Platforms like Edgen AI reveal real-time alpha signals , allowing traders to move first.

How AI Changes Alpha Trading

AI no longer represents trading’s future. It currently defines market success.

The Advantages of AI Trading:

- Instant Data Processing: AI evaluates huge datasets and instantly.

- Early Pattern Detection: AI spots trends before human traders.

- Emotion-Free Trading: Eliminates panic selling and impulsive buying .

- Real-Time Alpha Detection: Finds hidden opportunities before general awareness.

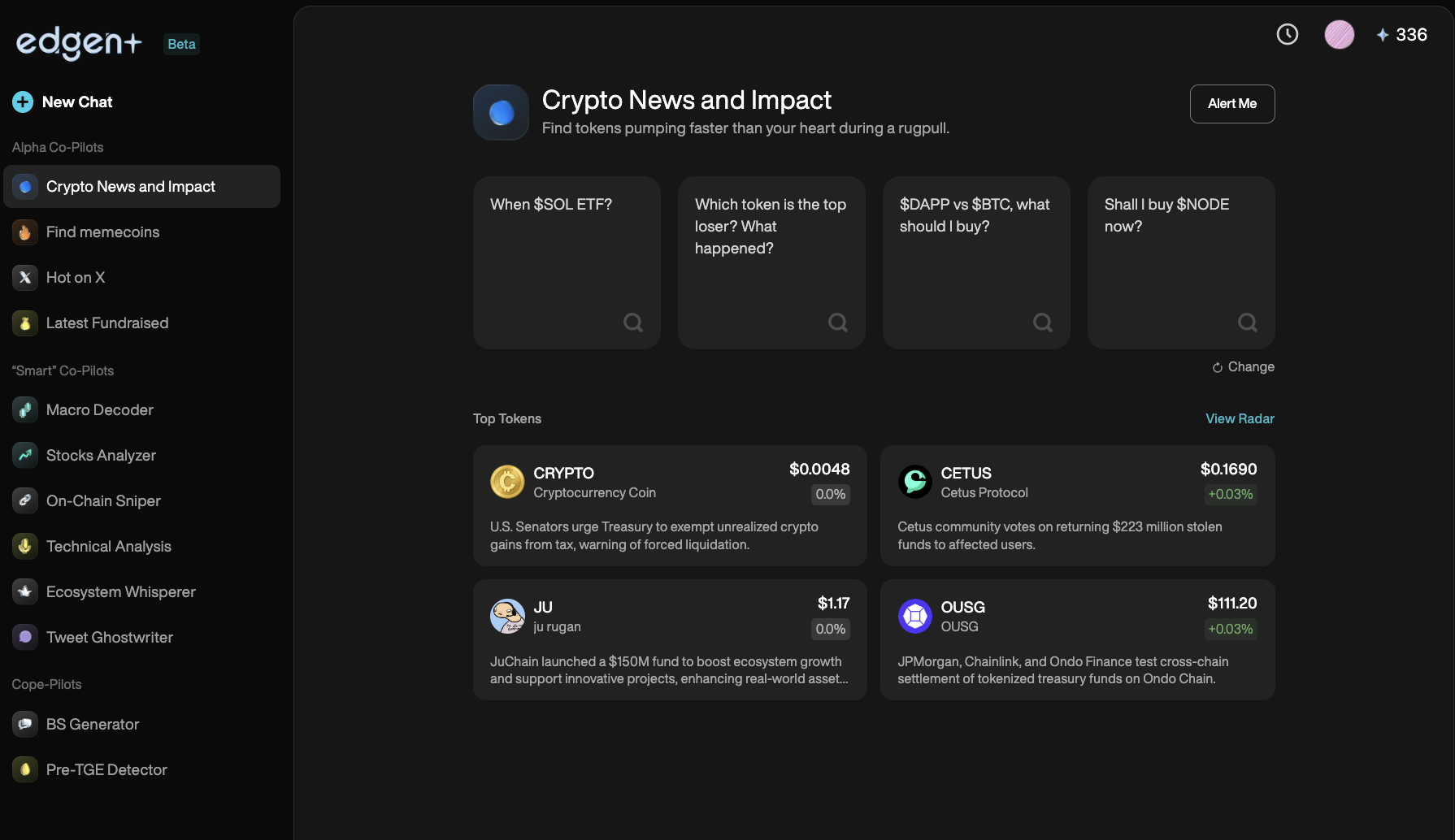

Edgen AI provides distinct tools designed for alpha trading:

- Edgen Radar: shows real-time market sentiment, price shifts, and alpha signals.

- Edgen Search: answers detailed market questions using verified data, eliminating noise.

- Edgen Insights: provides a collaborative hub for traders to share insights instantly.

Trading without AI severely limits market visibility. Edgen AI ensures traders see what others overlook.

Alpha Signal Trading: Finding Winning Trades

Alpha signals provide early indications of profitable trades.

Examples of Alpha Signals:

- Sudden Price Moves: Quick spikes or drops signal action points.

- Volume Surges: High trading activity indicates opportunities.

- On-Chain Activities: Whale wallets and influential wallet movements predict market moves.

- Social Sentiment: Community hype forecasts crypto price surges.

Edgen Radar identifies these signals instantly, while Edgen Search tracks influential traders and trending topics , allowing traders to act first.

Best Strategies for Alpha Trading Defined

To trade profitably, follow proven alpha strategies:

1. Trend Following

identify strong market trends early. Use AI alerts for timely entry and exit.

2. Mean Reversion

Trade identified overbought or oversold conditions back toward fair value. AI pinpoints optimal trade moments.

3. Smart Arbitrage

Instantly capture price differences between exchanges. AI bots automate execution efficiently.

Edgen AI develops specialized tools to execute these strategies precisely.

Why On-Chain Data Matters in Alpha Trading

Blockchain transactions provide insights, revealing critical trading signals:

- Smart Wallet Moves: Major wallets influence crypto market prices.

- Smart Contract Activity: DeFi trends emerge from active dApps.

- Liquidity Flows: Money movements to and from exchanges signal upcoming market shifts.

Edgen Radar provides real-time blockchain insights , allowing traders to act decisively ahead of others.

Common Trader Mistakes Explained (And How to Avoid Them)

- Mistake: Trading without a plan.

Solution: Define entry and exit points before entering a trade.

- Mistake: Ignoring social and blockchain data.

Solution: Recognize narratives and blockchain activities drive markets today.

- Mistake: Overtrading due to FOMO.

Solution: Prioritize quality over quantity. AI helps remove emotional biases.

- Mistake: Trading like typical retail investors.

Solution: Use AI, blockchain analytics, and automation tools for a decisive advantage.

The Future of Alpha Trading and AI

Trading strategies shifted toward AI, blockchain analytics, and social intelligence.

Where Alpha Trading Heads Next:

- AI Dominance: Machines predict and execute trades better than humans.

- Blockchain Analytics: On-chain data becomes standard market analysis.

- Social Intelligence: captures sentiment as the new fundamental metric.

Edgen AI leads this shift , integrating blockchain insights, social sentiment, and AI-driven strategies seamlessly.

How Traders Stay Ahead

Traders succeeding in alpha trading consistently follow these golden rules:

- use Edgen Radar, Edgen Search, and Edgen Feed for precise insights.

- monitor blockchain activities, particularly whale wallet movements.

- track social sentiment trends, as hype moves markets decisively.

- avoid emotional trading by strictly following data-driven AI signals.

- remain adaptive; market dynamics evolve constantly.

The best traders anticipate market movements before others follow.

.32b68d3b2129e802.png)

.ee9b0bcf9fc168ac.png)

.d8688e9eeef29939.png)