Retour

Retour

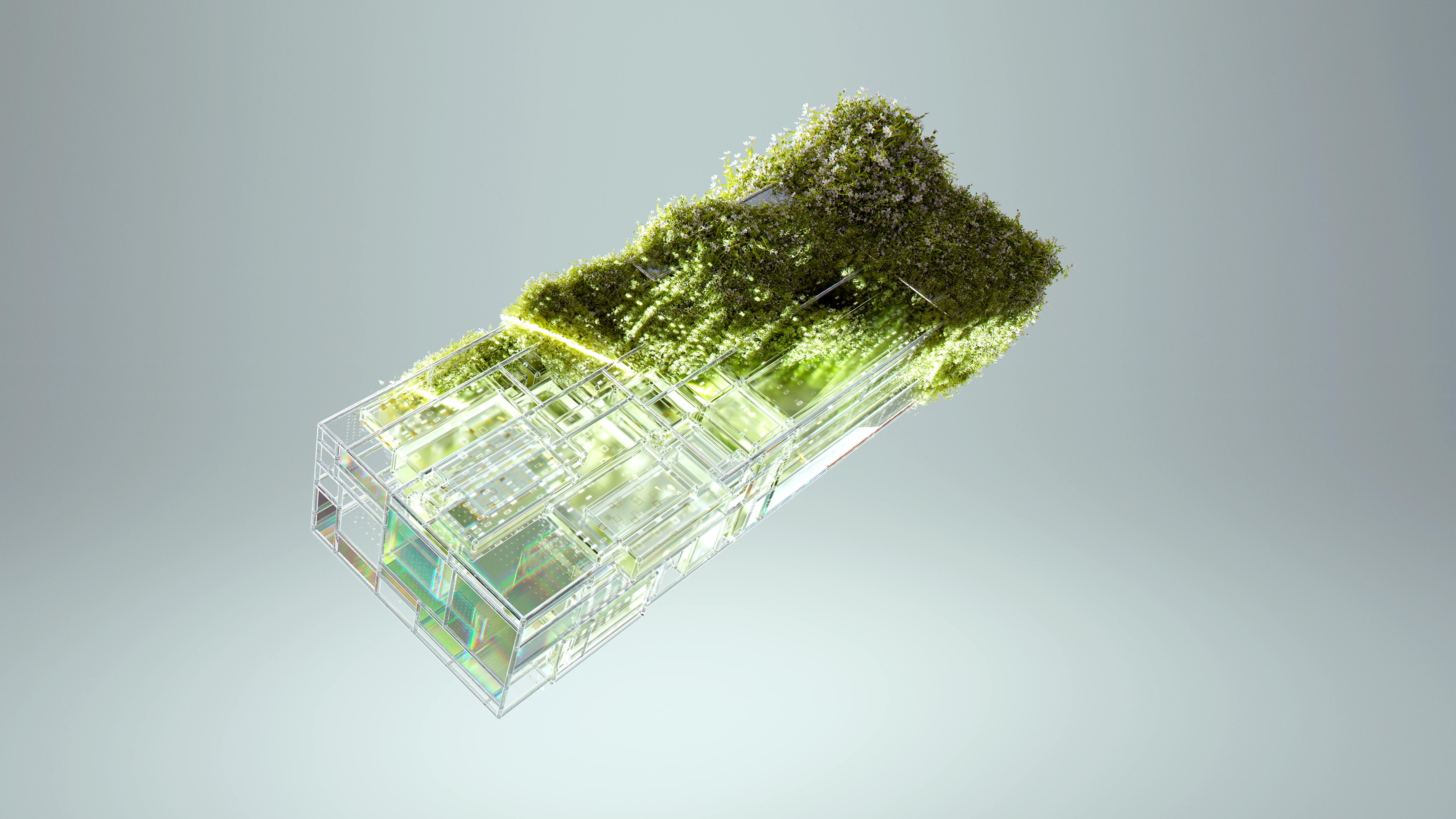

Le secteur de l'énergie nucléaire enregistre des gains significatifs grâce à la demande des centres de données IA

[1] Quelle bulle de l'IA ? Vistra réalise une performance puissante alors que les centres de données de l'IA alimentent la croissance nucléaire.[2] C'était une action phare de 2024. Qu'en pensent les analystes maintenant ? - Investopedia[3] Constellation et Vistra sur le point de publier leurs résultats dans un contexte de promotion du nucléaire par Trump | NAI 500

L'action Apple grimpe alors que les investisseurs boudent les 650 milliards de dollars de dépenses d'IA des géants de la technologieFeb 18 2026, 00:32Similarweb repasse dans le vert, dépassant les estimations du T4Feb 17 2026, 23:58Hormel Cède son Activité Dinde, Réaffirme ses Prévisions 2026Feb 17 2026, 23:57

Fonctionnalités

Ressources

© 2026 Finture Development Limited. Tous droits réservés.