Edgen:個人投資家と機関投資家のインテリジェンスのギャップを埋める

.20179c517b6479ef.png)

Edgen:個人投資家と機関投資家のインテリジェンスのギャップを埋める

SEOタイトル: Edgen AIで取引のギャップを埋める:個人投資家のためのパーソナライズされたインテリジェンス

説明: Edgen AIが、マルチエージェント分析、予測アラート、株式と暗号通貨の両方におけるリアルタイムインテリジェンスにより、個人投資家と機関投資家の間の隔たりをどのように埋めるかをご覧ください。

タグキーワード: Edgen AI、市場向けパーソナライズAI、個人トレーダー、機関トレーダー、投資向けマルチエージェントAI、取引ツール、市場インサイト、AI投資副操縦士、超パーソナライズアラート、株式と暗号通貨を一ヶ所で

I. 現代市場における真の格差

数十年にわたり、機関投資家は世界市場のペースを設定してきました。彼らは独自のデータ、自動分析、そして深い流動性に基づいて、他の誰よりも先に動いています。

個人投資家は、限られたツールと断片的な情報で取引してきました。その結果、スピード、知識、自信において明確な不均衡が生じています。

Edgen AIは、すべての投資家に機関投資家レベルのインテリジェンスへのアクセスを提供することで、そのギャップを埋めます。そのパーソナライズされたマルチエージェントシステムは、株式と暗号通貨の両方におけるリアルタイムデータを解釈し、明確で実用的な洞察を提供します。

II. 機関投資家レベルの明確さを個人投資家にもたらす

1. すべての人のための市場インテリジェンス

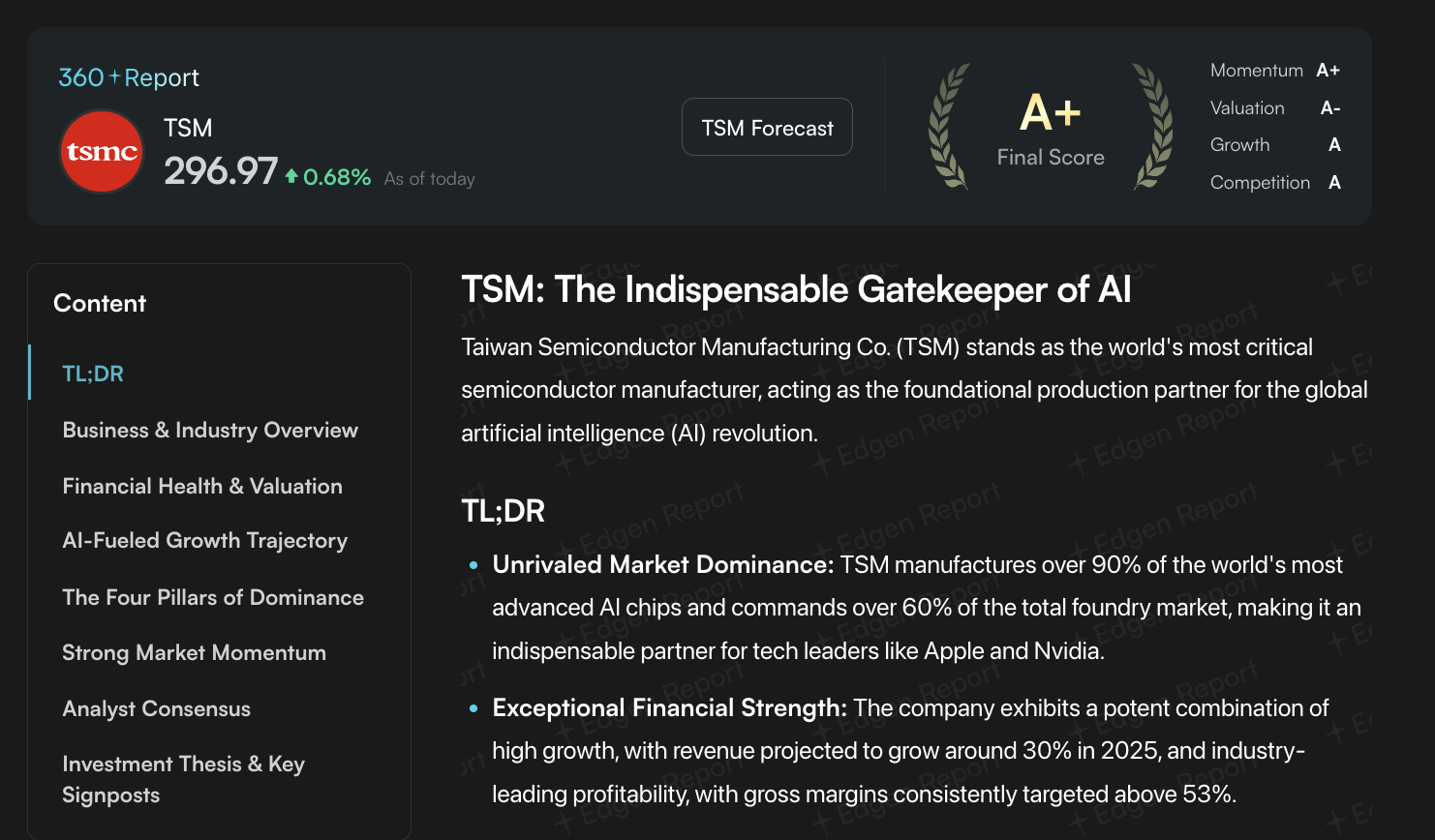

機関投資家チームは、ファンダメンタルズ、テクニカル、センチメントを監視するために専門家を雇用しています。Edgenは、360°レポートとテクニカルシグナルを通じてこの機能を再現し、ユーザーに市場状況の単一かつ一貫した理解を提供します。

各レポートは、モメンタム、バリュエーション、センチメントがどのように相互作用するかを説明し、投資家が感情ではなく状況に基づいて行動できるようにします。

アクセシビリティのために構築されたデータインフラストラクチャ

機関投資家は長年、膨大な量のデータを処理する内部パイプラインに依存してきました。Edgenは、個人向けに構築されたインターフェースで、同じレベルの構造と精度を提供します。

複雑な指標を、資本がどこに流れているか、センチメントがどのように変化しているかを示す直感的なダッシュボードに変換します。投資家は、従来のチャートに表示される前に動きを検知できるようになりました。

3. AIによる予測的洞察力

ボラティリティを予測することは、常にプロのトレーディングを定義してきました。Edgenのピボットアラートは、機械学習を適用して、局所的な高値、安値、流動性の変化を特定します。

投資家は潜在的な転換点に関する正確なアラートを受け取り、タイムリーなエントリー、エグジット、ポートフォリオ調整を可能にします。

これらの通知は、不透明なシグナルではなく透明なロジックによってサポートされており、それぞれの決定が検証済みのデータに基づいていることを保証します。

VII. なぜ重要なのか

金融市場は、人間が完全に追跡できないほどの速度で進化します。インテリジェンスが今や優位性を定義します。Edgenは、以下の要素を組み合わせることで、そのインテリジェンスをすべての投資家にもたらします。

- 個々のポートフォリオに適応するパーソナライズされた分析。

- ファンダメンタルズ、テクニカル、マクロトレンド、センチメントをカバーする専門エージェント。

- 株式とデジタル資産を1つの連続した洞察の流れに統合する統合ビュー。

その結果、断片的な観察を完全な理解に置き換えるフレームワークが実現しました。

VIII. 新しいアクセスの標準

Edgen AIは、投資家が学び、解釈し、決定する方法における静かな変化を象徴しています。個人投資家は、継続的な診断と適応的な推奨に導かれ、機関投資家が依拠するのと同じ分析規律にアクセスできるようになりました。

市場は常に迅速に動きます。Edgenは、洞察がより速く動くことを保証します。

市場ニュースと基本的なシグナルについては無料ティアから始め、高度な予測とより深いパーソナライゼーションについてはProおよびExpertに移行してください。

.32b68d3b2129e802.png)

.0c29d07d16f44e1b.png)

.8c8bc14ea764ad8b.png)

.0da86ba11512be44.png)